Exploring the landscape of Average Auto Insurance Quote by State in 2025, this introduction sets the stage for a detailed examination of the varying rates across different states. With a blend of informative content and engaging language, readers are drawn into the discussion from the get-go.

The subsequent paragraph will offer a detailed explanation of the topic, providing a clear understanding of the subject matter.

Overview of Auto Insurance Quotes in 2025

Auto insurance quotes are estimates provided by insurance companies to potential customers, outlining the cost of coverage based on various factors such as the driver's age, driving history, type of vehicle, and location.

These quotes can vary significantly from state to state due to differences in state regulations, population density, frequency of accidents, weather conditions, and other factors that can impact the risk associated with insuring drivers in a particular area.

Factors Affecting Auto Insurance Quotes by State

- State Regulations: Each state has its own set of insurance regulations that can impact the cost of coverage. For example, states with no-fault insurance laws may have higher premiums compared to states with traditional tort systems.

- Population Density: States with higher population densities tend to have more traffic congestion and a higher likelihood of accidents, leading to higher insurance rates.

- Weather Conditions: States prone to severe weather events such as hurricanes, tornadoes, or snowstorms may have higher insurance rates to account for the increased risk of damage to vehicles.

- Frequency of Accidents: States with a higher frequency of accidents may have higher insurance rates to cover the cost of claims payouts.

- Crime Rates: States with higher rates of vehicle theft or vandalism may have higher insurance rates to account for the risk of property damage.

Factors Influencing Auto Insurance Quotes

Auto insurance rates are determined by various factors that assess the risk associated with insuring a driver. These factors can vary depending on the state and can greatly impact the cost of insurance premiums.

Driving Record

A driver's history of accidents, traffic violations, and claims plays a significant role in determining auto insurance rates. A clean driving record typically results in lower premiums, while a history of accidents or violations can lead to higher rates.

Vehicle Type

The make, model, and year of a vehicle can also influence insurance rates. More expensive or high-performance cars may be more costly to insure due to the increased cost of repairs or replacement.

Location

The state and even the specific zip code where a driver resides can impact insurance pricing. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas with lower risk factors.

Coverage Limits

The level of coverage selected by a driver, including liability limits, comprehensive coverage, and collision coverage, can affect insurance rates. Higher coverage limits typically result in higher premiums.

Credit Score

In some states, credit score may be used as a factor in determining auto insurance rates. Drivers with lower credit scores may face higher premiums compared to those with better credit histories.

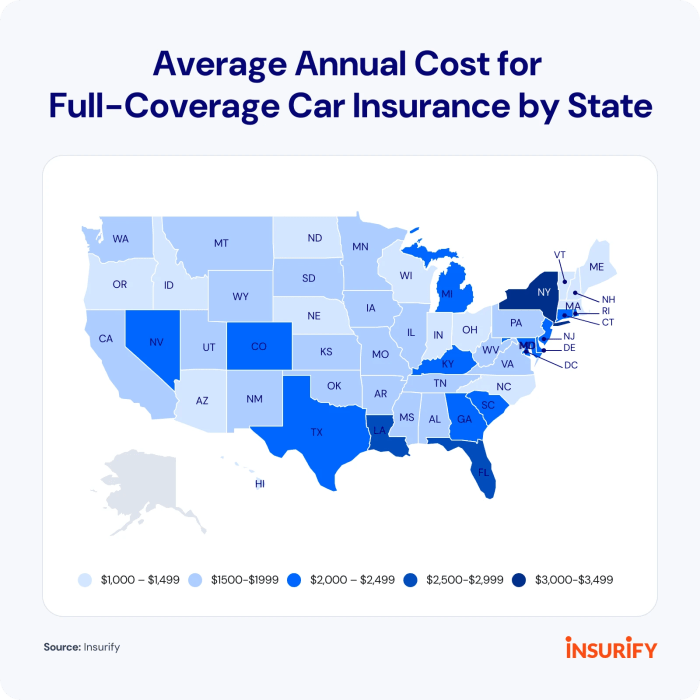

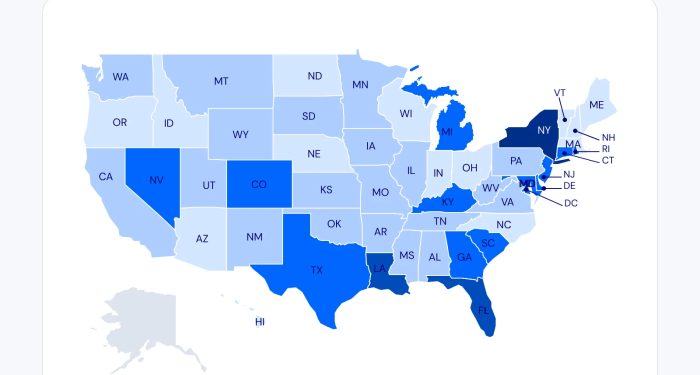

Comparison of Average Quotes Across States

When comparing average auto insurance quotes across different states in 2025, it becomes evident that there are significant variations in pricing. These differences can be attributed to various factors such as population density, traffic conditions, weather patterns, state regulations, and crime rates.

Table of Average Auto Insurance Quotes by State in 2025

| State | Average Quote |

|---|---|

| California | $1500 |

| Texas | $1200 |

| New York | $1700 |

| Florida | $1800 |

| Ohio | $1000 |

Trends and Predictions for 2025

In 2025, several trends are expected to impact auto insurance pricing across different states. These trends will likely lead to changes in average auto insurance quotes, influenced by various factors.

Increasing Adoption of Autonomous Vehicles

The increasing adoption of autonomous vehicles is predicted to have a significant impact on auto insurance pricing in 2025. As self-driving technology becomes more prevalent, the frequency and severity of accidents are expected to decrease. This reduction in accidents may lead to lower insurance premiums for drivers in states where autonomous vehicles are widely used.

Rising Costs of Repairs and Medical Treatment

Another trend that may affect auto insurance pricing in 2025 is the rising costs of vehicle repairs and medical treatment. With technological advancements in cars, the costs of repairing vehicles equipped with sophisticated features are expected to increase. Similarly, the rising costs of medical treatment may lead to higher insurance premiums to cover potential medical expenses resulting from accidents.

Climate Change and Natural Disasters

Climate change and the increasing frequency of natural disasters can also impact auto insurance pricing in 2025. States prone to extreme weather events may experience higher rates of claims due to weather-related damage to vehicles. This could result in higher premiums for drivers in these states to account for the increased risk of damage from natural disasters.

End of Discussion

In conclusion, this discussion has shed light on the intricacies of auto insurance pricing across states in 2025, offering valuable insights into what may influence these rates. With changing trends and predictions taken into account, it's evident that the landscape of auto insurance quotes is dynamic and subject to various factors.

FAQ Corner

What factors can influence auto insurance rates in different states?

Auto insurance rates can be influenced by factors such as population density, traffic conditions, crime rates, and state regulations.

Why do some states have higher average auto insurance quotes than others?

States with higher average quotes may have more urban areas, higher rates of accidents or theft, or different insurance regulations that impact pricing.

How do trends in 2025 affect auto insurance pricing?

Trends like advancements in technology, changes in driving habits, or new legislation can all impact auto insurance pricing in 2025.

![20 Best Online Computer Information Systems Degrees [2025 CIS Degree Guide]](https://technology.fin.co.id/wp-content/uploads/2025/10/colleges-best_1910-120x86.png)

![Is Computer Information Systems a Good Major? [2025 Guide]](https://technology.fin.co.id/wp-content/uploads/2025/10/computer-information-systems-careers-2-120x86.jpg)