Starting off with How to Get the Most from Costco’s Auto Insurance Discounts, this opening paragraph aims to captivate and engage the readers, providing a glimpse into the world of maximizing savings on auto insurance through Costco.

The following paragraph will delve deeper into the specifics and intricacies of leveraging Costco’s auto insurance discounts.

Understanding Costco’s Auto Insurance Discounts

Costco offers various auto insurance discounts to help customers save money on their premiums while still receiving quality coverage. These discounts are designed to reward safe driving habits, loyalty, and other factors that can lower the overall cost of insurance.

Types of Auto Insurance Discounts

- Safe Driver Discount: Customers who maintain a clean driving record with no accidents or violations are eligible for a discount on their premiums.

- Multi-Policy Discount: Costco offers discounted rates for customers who bundle their auto insurance with another policy, such as homeowners or renters insurance.

- Good Student Discount: Students who maintain good grades in school may qualify for a discount on their auto insurance premiums.

- Loyalty Discount: Customers who have been with Costco’s auto insurance for a certain period may receive a loyalty discount as a reward for their continued business.

Benefits of Costco’s Auto Insurance Discounts

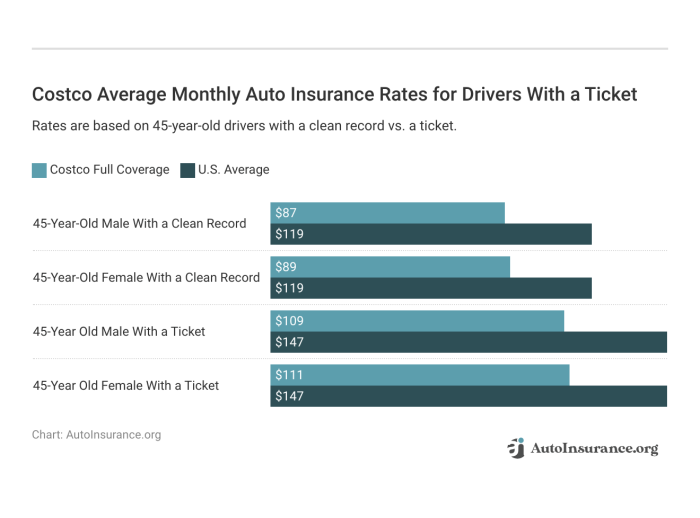

- Cost Savings: By taking advantage of these discounts, customers can significantly reduce their insurance costs compared to standard rates.

- Enhanced Coverage: Despite the discounted rates, customers still receive the same level of coverage and service that Costco is known for.

- Competitive Edge: Costco’s auto insurance discounts are competitive with other providers in the market, offering customers a cost-effective option without compromising on quality.

Eligibility Criteria for Costco’s Auto Insurance Discounts

To qualify for Costco’s auto insurance discounts, customers need to meet certain requirements and criteria. These discounts are typically available to Costco members who meet specific conditions set by the insurance provider.

Costco Membership

- Customers must be Costco members to access the auto insurance discounts offered through Costco.

- Membership tiers may vary, so it is important to check with Costco for specific details on eligibility.

Insurance Provider Requirements

- Customers may need to meet certain criteria set by the insurance provider, such as driving record, age, and vehicle type.

- Discounts may be available for safe drivers, multiple policies, or other qualifying factors.

Limitations and Restrictions

- Some restrictions may apply based on the state or region where the insurance is being offered.

- Discounts may have specific terms and conditions that need to be met to qualify for the reduced rates.

- It is important to review the details of the auto insurance discounts to understand any limitations or restrictions that may apply.

Maximizing Savings with Costco’s Auto Insurance Discounts

When it comes to getting the most out of Costco’s auto insurance discounts, there are several strategies you can implement to maximize your savings. By combining multiple discounts and reviewing your coverage periodically, you can ensure you are taking full advantage of the cost-saving opportunities available.

Leveraging Multiple Discounts

One effective way to increase your savings is by leveraging multiple discounts offered by Costco

Bundling Insurance Policies

Another smart strategy is to bundle your auto insurance policy with other types of insurance, such as homeowners or renters insurance. By consolidating your insurance policies with one provider, you can often qualify for additional discounts, ultimately saving you more money in the long run.

Periodically Reviewing Coverage

It's essential to periodically review your auto insurance coverage to ensure you are maximizing your savings. As your circumstances change, such as adding a new driver to your policy or purchasing a new vehicle, you may become eligible for additional discounts.

By staying informed and regularly reviewing your coverage, you can make sure you are not missing out on any potential savings opportunities.

Customer Experience with Costco’s Auto Insurance Discounts

When it comes to Costco’s auto insurance discounts, many customers have shared positive experiences and significant savings. Let's take a closer look at how customers have benefited from these discounts, address common misconceptions, and explore real-life scenarios where savings were maximized.

Testimonials and Reviews

- One customer mentioned that switching to Costco's auto insurance saved them over $500 annually compared to their previous provider.

- Another customer praised the excellent customer service they received when dealing with a claim through Costco's insurance.

Addressing Misconceptions

- Some customers may believe that Costco's auto insurance discounts are only available to certain demographics. However, Costco offers discounts to all eligible members, regardless of age or driving history.

- Another misconception is that the coverage might not be as comprehensive as other providers. In reality, Costco partners with reputable insurance companies to offer quality coverage at discounted rates.

Real-life Savings Scenarios

- A family of four saved over $800 per year by bundling their auto and home insurance through Costco's discount program.

- An individual driver reported saving 15% on their premium after taking advantage of Costco's safe driver discount and loyalty rewards.

Conclusive Thoughts

Concluding our discussion on How to Get the Most from Costco’s Auto Insurance Discounts, this final paragraph offers a compelling summary of key points discussed, leaving readers with valuable insights to maximize their savings.

Answers to Common Questions

What are the different types of auto insurance discounts offered by Costco?

Costco offers discounts for safe driving records, multiple policies, and certain affiliations.

What are the eligibility criteria to qualify for Costco’s auto insurance discounts?

Customers need to meet requirements such as having a good driving record and possibly specific memberships or affiliations.

How can customers maximize their savings with Costco’s auto insurance discounts?

Customers can leverage multiple discounts, bundle policies, and review coverage periodically to make the most of available discounts.

What is the customer experience like with Costco’s auto insurance discounts?

Customers have shared positive testimonials about saving money with Costco’s discounts. Common misconceptions can be addressed by understanding the benefits clearly.

Are there any limitations or restrictions associated with Costco’s auto insurance discounts?

Some limitations may apply, such as eligibility based on driving history and specific affiliations required for certain discounts.

![20 Best Online Computer Information Systems Degrees [2025 CIS Degree Guide]](https://technology.fin.co.id/wp-content/uploads/2025/10/colleges-best_1910-120x86.png)

![Is Computer Information Systems a Good Major? [2025 Guide]](https://technology.fin.co.id/wp-content/uploads/2025/10/computer-information-systems-careers-2-120x86.jpg)