Embark on a journey to unravel the intricacies of deciphering and comparing auto policy quotes accurately. Delve into a realm where understanding the nuances of insurance coverage becomes a breeze, ensuring you make informed decisions with confidence.

Explore the depths of auto policy quotes to unveil the secrets behind coverage limits, deductibles, and comparison strategies.

Understanding Auto Policy Quotes

When it comes to auto insurance, understanding the components of an auto policy quote is essential for making informed decisions about coverage and costs. Here we will delve into the key factors that influence the cost of auto insurance and the types of coverage typically included in most auto policy quotes.

Components of an Auto Policy Quote

An auto policy quote typically includes several key components that Artikel the details of the coverage being offered. These components may include:

- Liability coverage limits

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP) or medical payments coverage

- Deductibles

Factors Influencing Auto Insurance Costs

Several factors can influence the cost of auto insurance, including:

- Driving record

- Age and gender

- Location

- Type of vehicle

- Coverage limits and deductibles

- Credit score

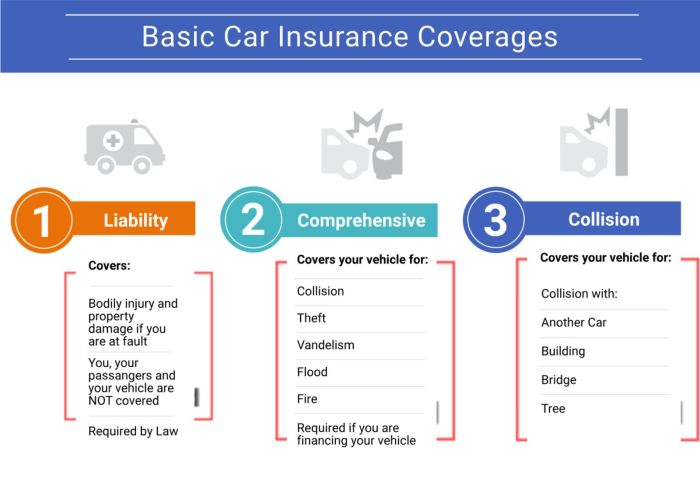

Types of Coverage in Auto Policy Quotes

Most auto policy quotes include various types of coverage to protect you and your vehicle. These may include:

- Liability coverage: Covers damages to others if you are at fault in an accident.

- Collision coverage: Pays for damage to your vehicle in an accident.

- Comprehensive coverage: Covers damage to your vehicle from non-collision incidents like theft or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you are in an accident with a driver who has insufficient insurance.

- Personal injury protection (PIP) or medical payments coverage: Pays for medical expenses resulting from an accident.

Reading Auto Policy Quotes

When reviewing auto policy quotes, it's essential to understand the coverage limits, deductibles, and any additional fees or charges listed. This information will help you make an informed decision when comparing quotes from different insurance providers.

Interpreting Coverage Limits

- Make sure to carefully review the coverage limits listed in the policy quote. These limits determine the maximum amount your insurance provider will pay for covered expenses.

- Pay attention to the liability limits for bodily injury and property damage. These limits indicate the maximum amount your insurance will cover in the event of an accident.

- Understand the comprehensive and collision coverage limits, which specify the maximum amount your insurance will pay to repair or replace your vehicle.

Impact of Deductibles

- Deductibles are the amount you are responsible for paying out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but you'll have to pay more in the event of a claim.

- Consider your budget and risk tolerance when choosing a deductible. Opting for a higher deductible can help you save on premiums, but be prepared to cover more expenses if you need to file a claim.

Additional Fees and Charges

- Check for any additional fees or charges listed in the policy quote, such as processing fees, installment fees, or policy fees. These extra costs can impact the overall affordability of the policy.

- Ask your insurance provider to explain any fees or charges you don't understand to ensure transparency and avoid surprises later on.

Comparing Auto Policy Quotes

When it comes to comparing auto policy quotes from different insurance providers, it's essential to look beyond just the premiums. You need to consider coverage options, policy limits, and the reputation of the insurance companies in order to make an informed decision.

Criteria for Comparing Coverage, Limits, and Premiums

- Check the coverage options: Look at what each policy covers, including liability, collision, comprehensive, and any additional riders or endorsements.

- Evaluate the policy limits: Compare the maximum amount the policy will pay out for different types of claims, such as bodily injury, property damage, and medical payments.

- Analyze the premiums: Consider the cost of the policy, including deductibles, discounts, and any additional fees.

Strategies for Evaluating Reputation and Customer Service

- Research customer reviews: Look for feedback from current and past policyholders to get an idea of the company's reputation for customer service and claims handling.

- Check financial ratings: Review independent ratings from agencies like A.M. Best, Moody's, or Standard & Poor's to assess the financial stability of the insurance company.

- Compare complaint records: Check with your state's insurance department or the National Association of Insurance Commissioners (NAIC) for information on complaints filed against the insurance company.

Ensuring Accuracy in Comparison

When comparing auto policy quotes, it is essential to avoid common pitfalls that can lead to inaccurate assessments. Understanding how policy details can vary between quotes and the importance of reviewing the fine print and exclusions can help you make an informed decision.

Common Pitfalls to Avoid

Before comparing auto policy quotes, be mindful of these common pitfalls that can skew your assessment:

- Not considering the same coverage limits and deductibles in each quote.

- Ignoring additional benefits or discounts offered by one insurer over another.

- Overlooking differences in policy exclusions and limitations.

- Forgetting to account for any fees or surcharges that may affect the overall cost.

Examples of Policy Detail Variations

Policy details can vary significantly between quotes, even when they seem similar at first glance. Here are some examples of how policy details can differ:

| Example 1: | One quote may include roadside assistance as a standard feature, while another may offer it as an optional add-on. |

| Example 2: | One insurer may have a lower premium but a higher deductible compared to another insurer with a higher premium and a lower deductible. |

| Example 3: | Some quotes may have exclusions for specific incidents or damages that others do not. |

Importance of Reviewing Fine Print and Exclusions

Reviewing the fine print and exclusions in each quote is crucial to ensuring you understand the full scope of coverage and any limitations that may apply. Paying attention to these details can help you avoid surprises and make a more accurate comparison between auto policy quotes.

Summary

In conclusion, mastering the art of reading and comparing auto policy quotes accurately empowers you to navigate the complex landscape of insurance with ease. Armed with knowledge and insight, you can now make well-informed choices that align with your needs and budget.

FAQs

How do I identify the key factors influencing the cost of auto insurance?

To determine the key factors affecting auto insurance costs, consider aspects like your driving record, vehicle type, coverage limits, and deductible amount.

What are common pitfalls to avoid when comparing auto policy quotes?

Common pitfalls include overlooking differences in coverage limits, neglecting to factor in deductibles, and failing to review fine print and exclusions.

How can I evaluate the reputation of insurance companies when comparing policy quotes?

You can assess the reputation of insurance companies by checking online reviews, ratings from consumer agencies, and customer feedback on their service quality.

![20 Best Online Computer Information Systems Degrees [2025 CIS Degree Guide]](https://technology.fin.co.id/wp-content/uploads/2025/10/colleges-best_1910-120x86.png)

![Is Computer Information Systems a Good Major? [2025 Guide]](https://technology.fin.co.id/wp-content/uploads/2025/10/computer-information-systems-careers-2-120x86.jpg)